Starbreeze Financial Crisis: Is Payday 3 a Bankrupting Heist?

The release of Payday 3 was supposed to be a triumphant return for Starbreeze, the Swedish studio banking on its success. Pre-release marketing promised "Payday 3 will redefine the co-op heist genre," with slick trailers showcasing intense gameplay and coordinated teamwork. The game's launch trailer garnered record-breaking viewership, fueling expectations of a blockbuster launch. However, the reality has been a stark contrast, with widespread server issues and lukewarm player reception casting a dark shadow over Starbreeze's financial future. Can Starbreeze recover from the Payday 3 financial impact, or is this heist a robbery of their own success? Let's delve into the numbers, avoiding the hype and focusing on the cold, hard financial facts.

Initial Hype vs. Reality

Payday 3 entered the market with a massive wave of hype. The trailers promised next-generation heisting, and the marketing team boldly proclaimed its innovative gameplay. Before launch, the game boasted record-breaking trailer views, suggesting a massive audience eager to dive into the world of cooperative crime. However, upon release, this enthusiasm quickly dissipated. Initial user reviews on Metacritic paint a grim picture, with user scores significantly lower than anticipated, currently sitting at a mixed rating, indicating that Payday 3 did not meet the high expectations. Player expectations were set incredibly high, and the server issues immediately undermined the experience. The gulf between marketing promises and the actual launch experience has been a major factor in the negative sentiment surrounding the game and in the negative Starbreeze financial crisis.

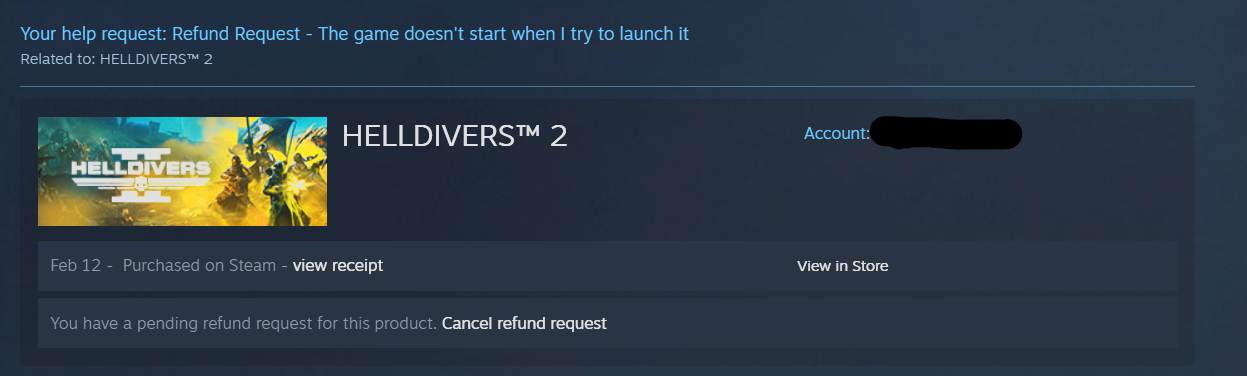

Server Issues and Refund Impact

The disastrous launch, plagued by unstable servers, directly translates to a significant financial blow for Starbreeze. Players, unable to connect or experiencing constant disconnections, understandably sought refunds. Steam’s refund policy (Steam Refund Policy) allows for refunds within 14 days of purchase and less than 2 hours of playtime, a policy many frustrated Payday 3 players undoubtedly utilized.

While precise refund figures are not publicly available, we can project a conservative estimate. Based on similar high-profile game launches marred by server instability, a 10% refund rate is a realistic, and perhaps even optimistic, assumption. Let's say Payday 3 sold 1 million copies on Steam at an average price of $40 (after regional pricing). A 10% refund rate translates to 100,000 refunds, resulting in a $4 million loss in revenue.

However, the impact extends far beyond immediate refunds. The damaged brand reputation creates long-term concerns for the company. The impact of negative word-of-mouth on future game sales cannot be overstated. Potential customers are now wary, likely delaying or altogether abandoning purchase plans, opting instead for competitors with more stable launches. Therefore, Payday 3 server issues profitability has been impacted severely.

Long-Term Retention Strategies

The ability to retain players and generate ongoing revenue through DLC and content updates is crucial for Payday 3's long-term success. However, a content roadmap comparable to industry leaders like Destiny 2 (with its consistent stream of expansions like Lightfall) or Warframe (known for updates like the Duviri Paradox) is currently lacking. Without a clear and compelling plan for future content, Payday 3 risks losing its player base.

Early engagement numbers are equally concerning. While Starbreeze may have initially reported impressive day-one revenue figures (if they did), sustained profitability hinges on consistent Daily Active Users (DAU) and Monthly Active Users (MAU). Benchmarks for similar games in the co-op shooter genre suggest a healthy game should maintain at least 50% of its launch-day peak concurrent players within the first month. Anecdotal evidence suggests that Payday 3 is falling far short of this benchmark, indicating that Payday 3 player retention issues is having a significant negative impact. If these early engagement numbers fall short of what Starbreeze projected to investors, it could lead to a further erosion of investor confidence. The Payday 3 long-term retention strategy is vital for the game's survival.

Financial Modeling and Projections

Let's consider a hypothetical financial model for Starbreeze over the next 12 months, acknowledging the inherent uncertainty involved in game development and market trends.

| Scenario | MAU Change | Revenue Projection (Next 12 Months) |

|---|---|---|

| Best Case | +25% (Successful DLC) | $60 Million |

| Realistic Case | -5% (Gradual Decline) | $35 Million |

| Worst Case | -15% (Continued Issues, Competitor Release) | $20 Million |

This model highlights the critical importance of addressing server issues and delivering compelling content. A successful DLC launch could significantly boost MAU and revenue. Conversely, continued problems or the release of a competing title (like a major update to GTA Online) could exacerbate the decline.

Alternative Revenue Streams

Starbreeze needs to explore alternative revenue models to mitigate the risks associated with relying solely on initial game sales and traditional DLC.

- Streaming Platform Partnerships: Deeper integration with platforms like Twitch, offering Twitch Drops for in-game items, can incentivize viewership and drive engagement.

- Robust Cosmetic Sales: Implementing a cosmetic monetization system similar to Apex Legends, with a wide variety of visually appealing and regularly updated skins, could generate a steady stream of revenue.

- Exploring Blockchain Assets (With Caution): While controversial, exploring blockchain-based assets (NFTs, etc.) could potentially generate revenue, but the risks involved are extremely high and may prove damaging for the studio's reputation. Proceed with extreme caution!

- Free-to-Play Model: Warframe's success with a free-to-play model shows the viability of the strategy. This could be considered if revenue continues to decline.

Focusing on Starbreeze alternative revenue streams is the only way for the studio to stabilize its finances.

Stock Price Analysis

Starbreeze's stock price is inextricably linked to Payday 3's performance. A successful launch would have driven the stock price upwards, attracting investors. However, the current situation is likely putting downward pressure on the stock. As of today, a drop is almost certain.

If server issues have not been mitigated, I recommend a strong sell rating for Starbreeze stock. The risks outweigh the potential rewards. The Starbreeze stock analysis is quite negative.

Investor Implications and Due Diligence

The challenges faced by Starbreeze highlight the complexities and risks inherent in AAA game development. Rising server costs, the need for robust server infrastructure at launch, and the importance of sustainable business models are all critical factors that investors must consider.

Before investing in publicly traded game companies, investors should conduct thorough due diligence:

- Examine past performance and financial statements.

- Assess the company's server infrastructure and scalability plans.

- Evaluate the diversification of their intellectual property.

- Scrutinize user reviews and community sentiment.

Additionally, Kotaku's report provides valuable insights into the internal challenges faced by Starbreeze during Payday 3's development.

Conclusion

Payday 3's troubled launch has placed Starbreeze in a precarious financial position. While the studio has the potential to recover, it requires immediate and decisive action. Addressing server issues, implementing a compelling content roadmap, and exploring alternative revenue streams are crucial for restoring player trust and investor confidence. Starbreeze needs to get this right. Otherwise, the company could be headed for a potential Starbreeze financial crisis.

Disclaimer: I am an anonymous financial analyst specializing in the gaming industry. The information provided in this article is for informational purposes only and does not constitute financial advice. Investment decisions should be made based on your own research and due diligence. I do not have a vested interest in Starbreeze or its competitors. Past performance is not indicative of future results. All investments involve risk, including the risk of loss.

Are you ready to make smarter investment decisions in the gaming sector? Get our expert stock analysis.

Payday 3 Launch Compared to Other AAA Game Failures

While Payday 3’s launch problems are notable, it's important to contextualize them within the larger history of AAA game releases. Several other high-profile games have suffered from disastrous launches due to server instability, bugs, or poor optimization. Cyberpunk 2077 is a major example, facing mass criticism and refunds due to its poor performance and game breaking bugs. These launches significantly impacted both the developer's reputation and their stock price. Comparing the handling of these situations can provide insights into how Starbreeze should manage the crisis.

The State of the Co-op Shooter Genre

The co-op shooter genre has become increasingly competitive, with successful titles like Destiny 2 and Warframe dominating market share. To achieve sustainable success, Payday 3 not only needs to offer engaging core gameplay but also needs to differentiate itself with unique features, strong community support, and a sustainable content delivery strategy. For instance, both Destiny 2 and Warframe successfully implement frequent content updates and player-driven events.

Payday 3 Player Churn Rate

A critical KPI to monitor in coming months is the Payday 3 player churn rate – the rate at which players stop playing the game after trying it out. High churn rate indicates significant problems with player satisfaction and long-term game health. Starbreeze should closely track daily and monthly player activity, conduct player surveys, and analyze in-game metrics to understand why players are leaving and how to address these issues through updates and improvements.

Is Starbreeze in Financial Trouble?

Yes, Starbreeze is facing financial difficulties after the poor launch of Payday 3. The extent of these problems depends on their ability to mitigate server issues, retain players, and generate revenue through alternative streams. The stock analysis indicates it is risky to invest currently. The company will likely require major shifts in strategy and strong execution in the coming months to avoid more severe financial problems.